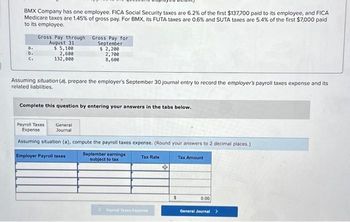

Fica Taxes 2025: Social Security & Medicare Information + Examples

As part of FICA, Medicare taxes are collected on tip earnings, just as they’re on common wages. Both employees and employers must guarantee these earnings are appropriately reported and that the appropriate FICA tax is paid. If you’ve questions about how ideas affect your contributions to Medicare or need help figuring out your eligibility for Medicare Benefits, please give us a name for personalized steering. Bonuses, though a delightful addition to your regular earnings, are also topic to FICA taxes.

Limits On Fica Taxes

Importantly, high earners face an Further Medicare Tax of 0.9% on income over the edge amounts listed above—this applies to both staff and self-employed staff. If you are self-employed, you are liable for the total FICA tax, masking both Social Security and Medicare taxes, which is named the Self-Employment Tax. Whereas “FICA” and “Medicare” have distinct roles within this tax, self-employed individuals must pay each to remain in good standing for future Medicare advantages. This can be a significant consideration for these managing their own companies.

How The Social Security Tax Capabilities

Self-employed individuals are liable for the full 12.4%, but they can deduct half of this quantity when submitting their revenue tax return. Withdrawals out of your retirement financial savings, like a 401k plan, are topic to different tax rules than common income. Notably, FICA taxes—comprised of Medicare and Social Safety taxes—are not applied to 401k withdrawals. When you are taking cash out of your 401k, the distribution is usually topic to ordinary income tax however exempt from FICA taxes.

The Social Safety Administration temporarily withholds $1 of a employee’s advantages for every $2 earned over $23,400 in 2025. A massive increase in Medicare premiums can devour almost half of your annual improve. The 2025 Social Safety Trustees Report projects a $206.50 monthly premium for next 12 months, up $21.50 or 11.6% from 2025. That would characterize the biggest Part B improve in dollar terms since 2022, when premiums rose by $21.60. Understanding this difference helps underscore why FICA is important in maintaining the well being of Social Security and Medicare, providing a safe financial fallback. Our companions cannot pay us to guarantee https://www.intuit-payroll.org/ favorable evaluations of their services or products.

In 2025, contribution limits are $4,300 (individual) and $8,550 (family), with a $1,000 catch-up for those over fifty five. Prior to becoming an editor and content strategist, she coated small enterprise and taxes at NerdWallet. She has a degree in finance, as well as a master’s degree in journalism and an MBA. Previously, she was a financial analyst and director of finance at private and non-private firms.

Employers should retain payroll tax information for a minimum of 4 years in case of IRS review. Lottery winnings are subject to distinctive tax considerations, and it’s crucial to distinguish between earnings tax and FICA taxes, which embody Medicare and Social Security. Opposite to common earnings, lottery winnings are not subject to FICA taxes. Whereas “FICA” and “Medicare” are intertwined, lottery winnings fall outside the scope of those payroll taxes. As An Alternative, lottery winnings are typically taxed as strange income at the federal (and possibly state) degree with out FICA deductions.

- Tina’s work has appeared in quite so much of local and national media retailers.

- Contact your state’s Division of Income for details about estimated tax payment guidelines where you reside.

- These deductions are mandatory they usually contribute in the direction of your Social Safety and Medicare benefits.

- You may use the PaystubsNow paycheck stub maker to generate paystubs making certain all tax deductions are calculated appropriately.

Sure, employers are required to match the FICA contributions made by staff. For each dollar an employee contributes, the employer must contribute the identical quantity towards Social Safety and Medicare. Married employees who file collectively whereas earning over $250,000 yearly or file separately while incomes over $125,000 yearly are also subject to this extra tax. We do not sell insurance coverage products, provide enrollment services, or represent any insurance coverage provider, agent, or plan. All data provided on this website is intended for common information solely and shouldn’t be interpreted as professional advice or an various alternative to consulting official authorities resources. The thresholds for the Additional Medicare Tax remain at $200,000 for single filers, $250,000 for joint filers, and $125,000 for married people submitting separately.

Knowing the difference between “FICA” and “Medicare” is essential when exploring these exemptions, as they relate however usually are not equivalent. FICA tax exemptions can scale back the quantity taken from your paycheck and affect your future advantages. It’s crucial to comprehend these exemptions to ensure you’re nonetheless adequately covered for Medicare if you retire. If you’ve questions or need clarification on how FICA tax exemptions might impression your Medicare eligibility, we’re here to assist. For 2021, the Social Safety tax is deducted from earnings as much as an annual maximum of $142,800, marking the wage base limit for that year; earnings over this level are exempt. The cash is utilized by Medicaid services to supply working People a retirement savings and insurance scheme with disability benefits.

If you need assistance with tax services, we help with every thing from tax preparation to filing and maintaining your business on track. With Profitjets, you’ll be able to know that experienced professionals deal with your payroll and taxes. Sure, no matter your business construction, you can deduct the employer portion of FICA taxes as a business expense in your federal income tax return. Sure, all employees should pay FICA taxes on their gross wages on each paycheck, including taxes for Social Safety and Medicare. Employers calculate taxes by multiplying worker wages by the present Social Security and Medicare charges, withholding quantities every pay period, and matching the sums before remitting to the IRS.

The Federal Insurance Coverage Contributions Act (FICA) is a U.S. law requiring payroll taxes to be withheld from employees’ wages and matched by employers. These taxes fund Social Safety and Medicare, which give monetary assist for retirees, disabled individuals, and people needing medical care. Social Safety and Medicare taxes make up the spine of America’s social security web, and their collection is governed by the Federal Insurance Contributions Act, or FICA. Each celebration contributes an equal proportion for each Social Security and Medicare taxes, while self-employed individuals must pay both shares themselves, resulting in a better total tax price.

Fica Tax On Overseas Income

A voided examine has your bank information on it, which allows the government to deposit your refund directly into your account. This makes it quicker and safer than receiving a bodily check within the mail. Just ensure you write ‘VOID’ throughout the front of the examine to stop it from being misused. FICA and SECA taxes don’t fund Supplemental Security Revenue (SSI) benefits, despite the very fact that that exact program is run by the Social Safety Administration (SSA). Moreover, you’d pay an additional 0.9% Medicare tax on self-employment revenue above the edge. Though the speed is ready annually, it has principally stayed the identical since 1990.